However if the employers contribution towards employees EPF account NPS and superannuation fund is more than Rs 75 lakh the excess contribution will be taxable as a. Courts will consider factors such as whether the allowances are a fixed sum payable to employees on.

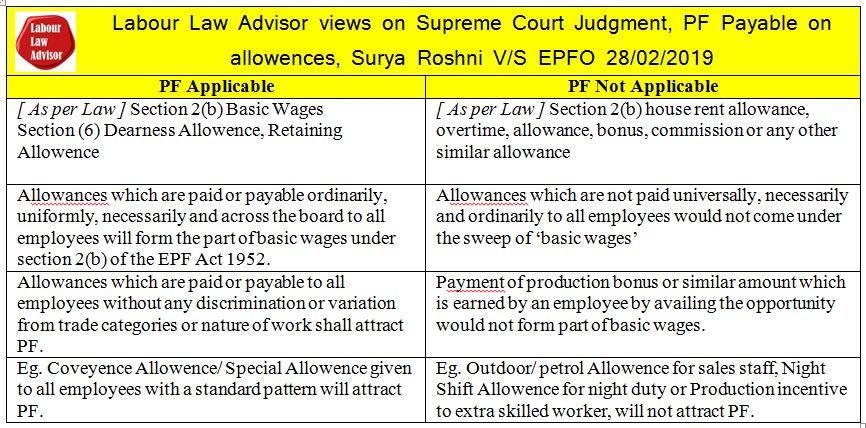

Supreme Court Epf Judgement 2019 Labour Law Advisor

EPF Interest Rates 2022 2023.

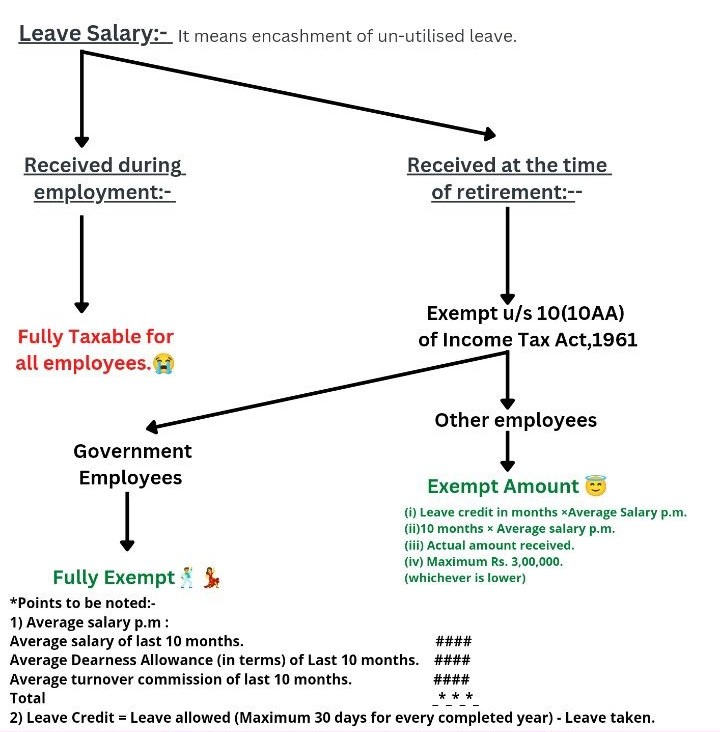

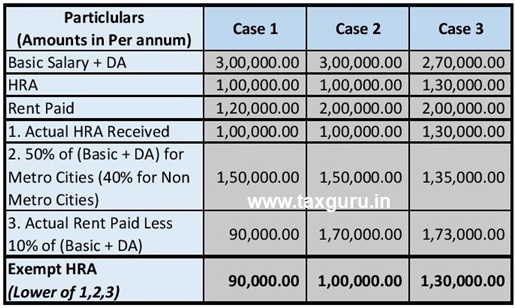

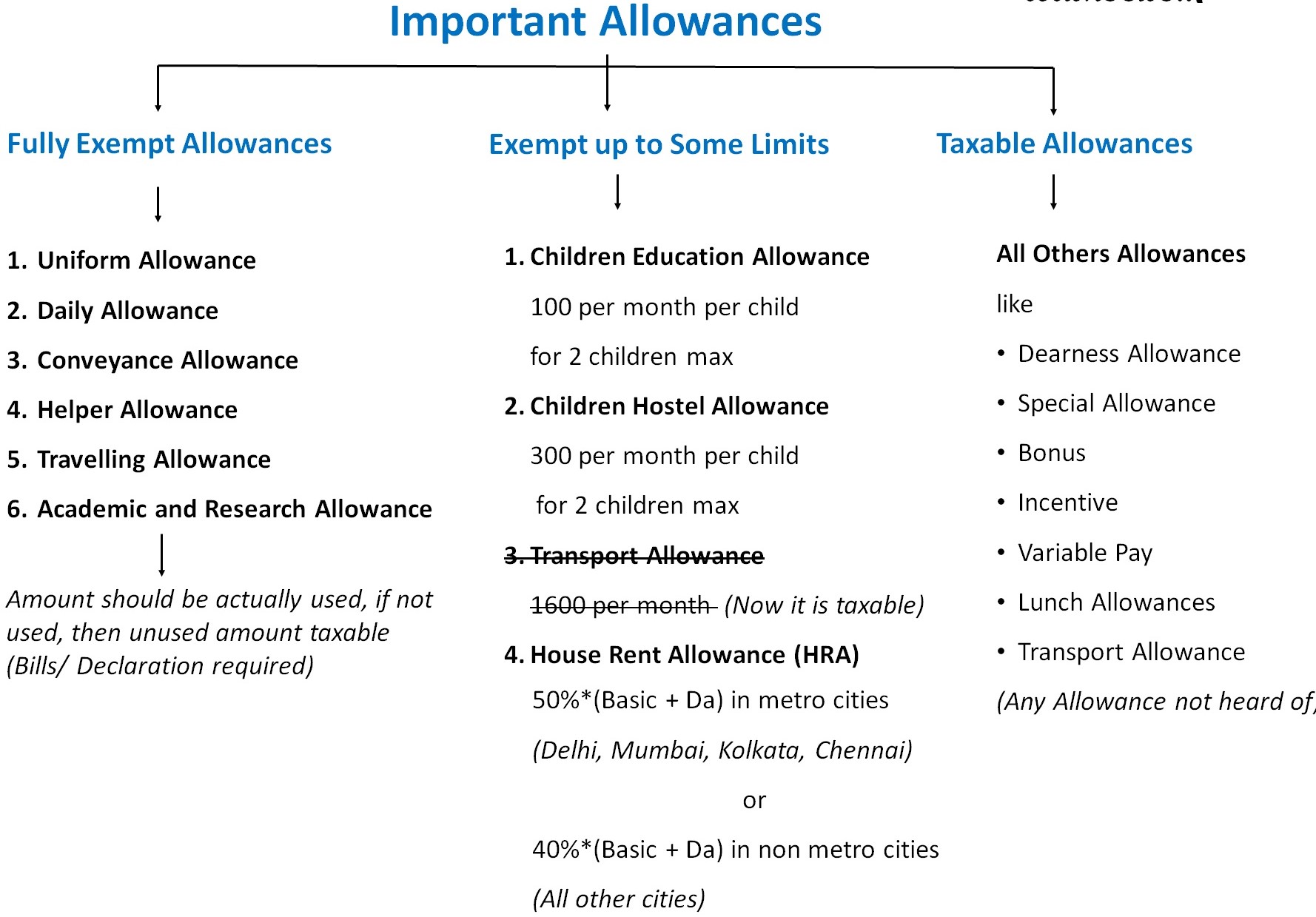

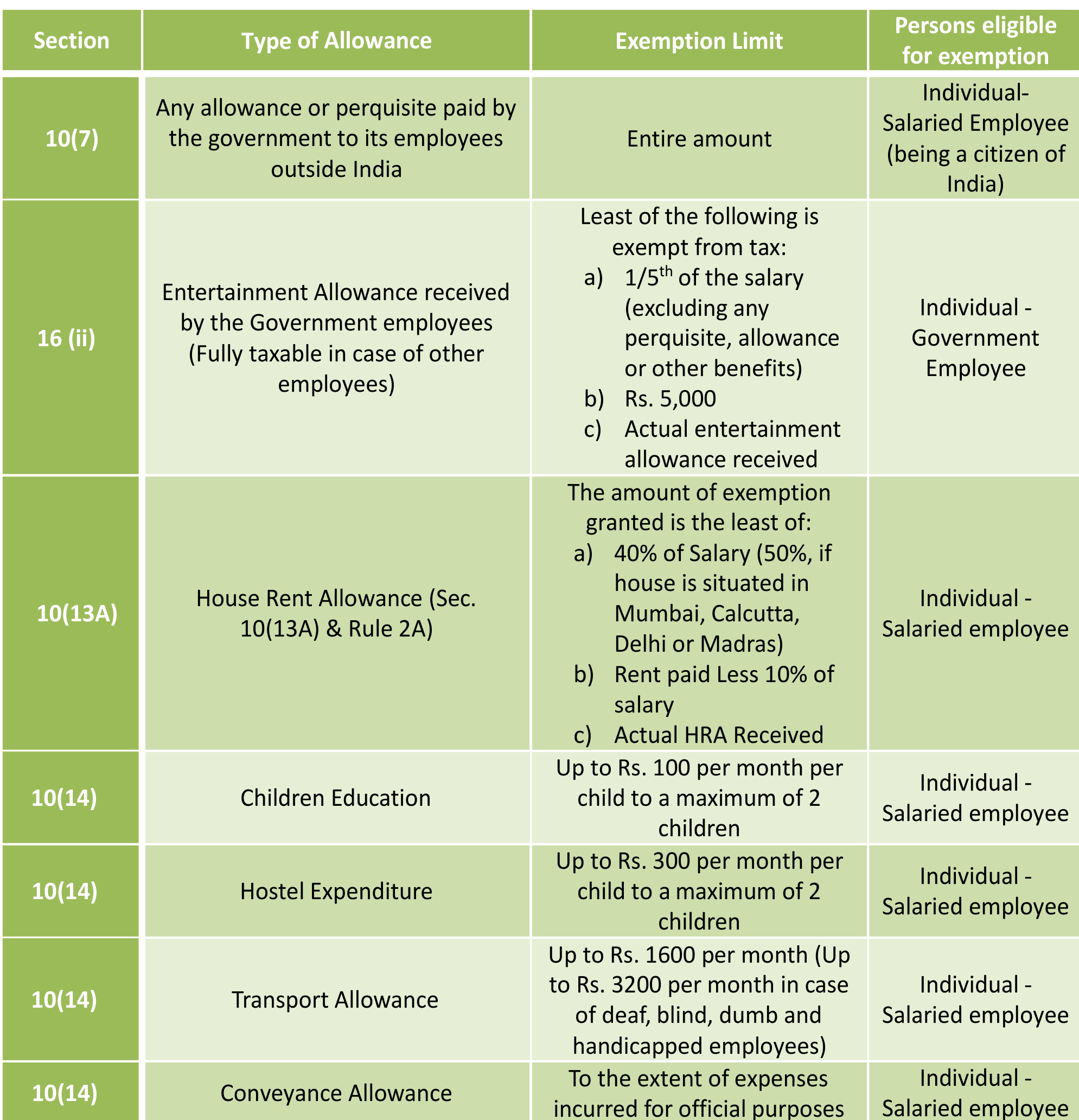

. Under Section 10 there are different sub-sections that define what kind of income is exempt from tax. EPF is calculated on the salary where salary Basic DA Dearness Allowance In private organisations salary Basic. Here salary does not include your HRA conveyance allowance special allowance or any other benefit given in your salary slip.

Above 15000 ft - Rs1600 pm. Island Duty allowance granted to armed forces in Andaman Nicobar and LakshadweepRs3250 per month. Current EPF Interest rate is 865.

Allowance for working in underground minesRs800 per month. However as the word is broad enough to include payments for food clothes accommodation phone calls etc reference can be had to case law to ascertain its scope. The interest rate on EPF is reviewed on a yearly basis.

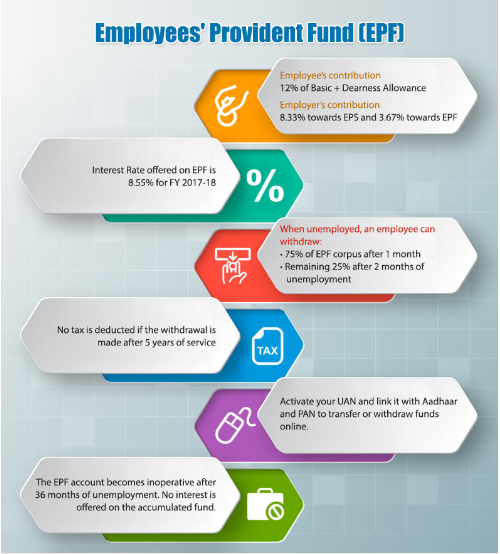

This 12 however is divided into two accounts-1. This can range from agricultural to house rent allowance. The EPF interest rate for the fiscal year 2022-23 is 810.

Monthly EPF contribution brought down to 20 for May June and July 2020 will now go back to its erstwhile figure of 24 starting August 1 2020. Any income that an individual acquires or earns during the course of a financial year that is deemed to be non taxable is referred to as Exempt Income. Latest news related EPF withdrawal.

The EPF contribution is either 1800 INR per month or 12 of the salary. Special compensatory highly active field area allowanceRs4200 pm. The EPF interest rate for FY 2018-2019 is 865.

Employees EPF Contribution as a of Salary Generally 12. Employees contribution towards EPF 12 of Rs 50000 Rs 6000. Your employer needs to contribute 12 too.

When the EPFO announces the interest rate for a fiscal year and the year closes the interest rate is computed for the month-by-month closing balance and then for the entire year. Allowance except travelling allowance is included in the definition of wages under the EPF Act. EPF Contributions To Be Deducted at 24 from August 1 2020.

Once you provide these inputs the EPF Calculator does all the hard work for. It makes EPF one of the most tax-efficient investments. So the Total EPF contribution every month Rs 6000 Rs 1835 Rs 7835.

Allowance for armed forces in a high altitude region9000 - 15000ft - Rs1060 pm. Generally companies in the private sector dont have a dearness allowance component so its only the Basic Salary that becomes the base for EPF calculation. Employers EPF Contribution as a of Salary Generally 367.

The contribution by the employee is equally matched by the employer. It falls under the EEE exempt exempt exempt category where the accrued interest and the amount accumulated on withdrawal are tax-free. So thats another 12.

Lets say your salary Basic Salary Dearness Allowance Rs 50000 per month. That means 12 of your salary goes into your PF account. Your Monthly Salary Basic Pay Dearness Allowance Expected Increase in Salary every year in percentage EPF Interest Rate.

Now following are the contributions made by you employee and the employer. The contribution split equally at the rate of 10 between the employer and.

All About Allowances Income Tax Exemption Ca Rajput Jain

10 Types Of Employee Payments Apart From Salary That Businesses Need To Pay Cpf For Dollarsandsense Business

Special Allowances In India Under Income Tax Return Itr Taxhelpdesk

Allowances Exempt From Tax For Salaried Person Most Useful Planmoneytax

Which Allowance Is Exempt From Epf Madalynngwf

Exempted Allowances To Salaried Persons Simple Tax India

Do You Need To Make Epf Payments For Bonuses And Cash Allowances In Malaysia Althr Blog

What Payments Are Subject To Epf Donovan Ho

Washing Allowance Exemption In Form 16 Under Section 10 Using It 0582 Sap Blogs

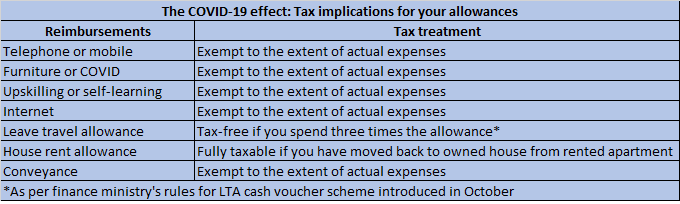

Work From Home Here Is How Reimbursements And Allowances Will Be Taxed

All About Allowances Income Tax Exemption Ca Rajput Jain

Which Allowance Is Exempt From Epf Madalynngwf

All About Allowances Income Tax Exemption Ca Rajput Jain

Salary Segments That Can Reduce Employees Tax Liabilities Sag Infotech Salary Segmentation Tuition Fees

All About Allowances Income Tax Exemption Ca Rajput Jain

Tax Benefits On Epf Employer Employee Contribution Impact Of Withdrawal Before 5 Years Saving For Retirement Facts Money Today

Download Gratuity Calculator India Excel Template Msofficegeek Payroll Template Excel Templates Dearness Allowance

What Is Form Ea Part 2 Defining The Perquisites